EMISSIONS: New York Gov. Kathy Hochul intends to revive plans for congestion pricing in parts of New York City, dropping the toll to $9 from $15, before the new Trump administration can squash the plan. (New York Times)

ALSO:

TRANSMISSION: The developers behind a 145-mile transmission line intended to import Canadian hydropower to Massachusetts sue NextEra Energy, alleging the electric utility purposely misled voters and physically blocked progress to protect its turf and stop the project. (MassLive, subscription)

SOLAR:

NUCLEAR: Small modular nuclear reactors could be the key to providing onsite energy for power-hungry big tech companies and convincing them to set up shop in New York, says Gov. Hochul. (Times Union)

EFFICIENCY: Burlington, Vermont’s plan to weatherize more than 700 rental properties is seriously behind schedule because of a shortage of workers trained to do the upgrades. (Seven Days)

CLIMATE: As New York falls behind on its climate goals, the state needs to ramp up its procurement of renewable energy, advocates say. (Canary Media)

OFFSHORE WIND: Seven Cape Cod towns vote against supporting offshore wind development on a ballot question that is nonbinding but raises questions about the region’s appetite for wind. (Cape Cod Times)

STORAGE: New Jersey utilities regulators modify their proposed incentive plan for grid-scale battery storage projects, as the state aims to reach 2,000 MW of capacity by 2030. (RTO Insider, subscription)

GRID:

COMMENTARY: Grid operator PJM should look to battery storage and other creative solutions to meet high demand rather than leaning on existing coal plants that hurt nearby communities, an Appalachian equity advocate says. (Utility Dive)

A Massachusetts university is developing technology that aims to use lasers to drastically cut emissions and energy use from Maine’s paper and pulp industry.

Worcester Polytechnic Institute recently received a $2.75 million U.S. Department of Energy grant to help ready the industrial drying technology for commercial use.

“We are all excited about this — this is potentially a groundbreaking technology,” said Jamal Yagoobi, founding director of the institute’s Center for Advanced Research in Drying.

In Maine, the paper and pulp business generates about 1 million metric tons of carbon dioxide emissions each year, roughly half of the state’s industrial emissions. Much of these emissions come from the process of drying mashed, pressed, and rolled wood pulp to yield paper products. The emissions come mainly from three major operations across the state; three additional facilities contribute smaller amounts.

These plants’ emissions will need to be addressed if Maine is to reach its goal of going carbon neutral by 2045. Furthermore, each of these plants is located in an area with an above-average population of low-income residents, according to data assembled by Industrious Labs, an environmental organization focused on the impact of industry. And two are located in areas with a higher-than-average risk of cancer from air toxins, suggesting a correlation between their operations and the incidence of cancer in the area.

At the same, the paper and pulp industry remains economically important to Maine, said Matt Cannon, state conservation and energy director for the Maine chapter of the Sierra Club.

“It’s got real union jobs — the paper industry is still very important to our community,” he said.

Worcester Polytechnic’s drying research center has been working on ways to dry paper, pulp, and other materials using the concentrated energy found in lasers. The lasers Yagoobi’s team is using are not the lasers of the public imagination, like a red beam zapping at alien enemies. Though the lasers are quite strong — they can melt metal, Yagoobi says — they are dispersed over a larger area, spreading out the energy to evenly and gently dry the target material.

Testing on food products has shown that the technology can work. Now, researchers need to learn more about how the laser energy affects different materials to make sure the product quality is not compromised during the drying process.

“For paper, it’s important to make sure the tensile strength is not degrading,” Yagoobi said. “For food products, you want to make sure the color and sensory qualities do not degrade.”

Therefore, before the system is ready for a commercial pilot, the team has to gather a lot more data about how much laser energy is incident on different parts of the surface and how deeply the energy penetrates different materials. Once gathered, this data will be used to determine what system sizes and operating conditions are best for different materials, and to design laser modules for each intended use.

Once these details are worked out, the laser technology can be installed in new commercial-scale drying equipment or existing systems. “This particular technology will be easy to retrofit,” Yagoobi said.

Industrial sources were responsible for about 1.3 billion metric tons of carbon dioxide emissions in the United States in 2023, about 28% of the country’s overall emissions, according to the U.S. Energy Information Administration. Heating processes, often powered by natural gas or other fossil fuels, are responsible for about half of those emissions, said Evan Gillespie, one of the co-founders of Industrious Labs. Many industrial drying processes require high temperatures that have traditionally been hard to reach without fossil fuels, giving the sector a reputation as hard to decarbonize, Gillespie said.

“The key challenge here is: How do you remove natural gas as a heating source inside industrial facilities?” said Richard Hart, industry director at the American Council for an Energy-Efficient Economy. “The scale of what is happening in industry is enormous, and the potential for change is very powerful.”

To make the new technology effective, industry leaders and policymakers will need to commit to reinvesting in old facilities, Gillespie noted. And doing so will be well worth it by strengthening an economically important industry, keeping jobs in place, and creating important environmental benefits, he added.

“There’s often this old story of tensions between climate and jobs,” Gillespie said. “But what we’re trying to do is modernize these facilities and stabilize them so they’ll be around for decades to come.”

EMISSIONS: Greenhouse gas emissions from electricity generation in New England dropped 4% last year, due to mild weather, lower natural gas prices, and increases in solar and wind energy, the region’s grid operator reports. (Maine Public)

EFFICIENCY: Massachusetts utilities submit their latest three-year energy efficiency plan for regulatory approval, with the goal of installing heat pumps in more than 119,000 homes and creating $13.7 billion in benefits for consumers. (Utility Dive)

GRID:

FOSSIL FUELS: Despite burgeoning power demands from cryptocurrency and AI operations, New York state may have built its last fossil fuel power plant, some clean energy advocates say. (New York Focus)

OFFSHORE WIND:

ELECTRIC VEHICLES: A Vermont electric aircraft startup tops $1 billion in equity capital, but questions remain about the climate benefits of the technology. (Canary Media)

SOLAR:

COMMENTARY: New York should delay implementation of rules requiring more electric truck sales to allow charging infrastructure and technology to improve, says a spokesperson for the retail lumber industry. (Long Island Press)

COAL: Ameren Missouri would spend $61 million on high-efficiency air filters for residents and electric school buses under a proposed agreement to settle past clean air violations at a St. Louis-area coal plant. (Missouri Independent)

ALSO: Indiana regulators approve AES’ plan to transition two coal plant units to run on gas, despite opposition from the coal industry and U.S. Sen. Mike Braun, who was elected Tuesday as the state’s next governor. (Indiana Capital Chronicle)

CLEAN ENERGY: The incoming Trump administration is likely to reverse federal regulations limiting emissions from power plants and light- and heavy-duty vehicles, and could jeopardize America’s global climate leadership, experts say. (Canary Media, Inside Climate News)

ELECTION:

SOLAR: A solar installer and the Standing Rock Sioux Tribe run an apprenticeship program that promotes workforce development and builds renewable energy projects on tribal land across the Great Plains. (Buffalo’s Fire)

EFFICIENCY: A historic former train station in Detroit that was recently renovated and reopened to house various startups is also equipped with various energy-efficiency upgrades. (FacilitiesNet)

BIOFUELS: Biofuel options outside of corn could play a key role in a more climate-friendly future for Indiana’s biofuels industry. (WFYI)

COMMENTARY: Voters’ rejection of a South Dakota law to regulate carbon pipelines in Tuesday’s election may have been influenced by a broader campaign in the state to vote ‘no’ on several initiatives that were on the ballot, an editor writes. (South Dakota Searchlight)

North Carolina regulators on Friday accepted Duke Energy’s controversial plan for curbing carbon pollution, a blueprint that ramps up renewable energy and ratchets down coal power but also includes 9 gigawatts of new plants that burn natural gas.

The biennial plan is mandated under a 2021 state law, which requires Duke to zero out its climate-warming emissions by midcentury and cut them 70% by the end of the decade.

The timing of the order from the North Carolina Utilities Commission, two months ahead of schedule, caught many advocates by surprise. But its content did not: it hewed closely to a settlement deal Duke reached this summer with a trade group for the renewable energy industry; Walmart; and Public Staff, the state-sanctioned ratepayer advocate.

But critics were dismayed by regulators’ abdication of the 2030 deadline. The ruling said Duke no longer needed a plan to make the reductions by decade’s end, instead telling it to “pursue ‘all reasonable steps’ to achieve the [70%] target by the earliest possible date.”

“Major step back on climate,” Maggie Shober, research director at the Southern Alliance for Clean Energy,” wrote on X, the website formerly known as Twitter, adding, “for those that say it couldn’t be done, Duke had a 67% reduction by 2030 in its 2020 [long-range plan.] The utility industry generally, and Duke in particular, has had opportunity after opportunity to do better. They chose not to, and here we are.”

And while many observers say the three large gas plants approved in the near-term carbon plan are better than the five originally proposed by Duke, detractors note the facilities still could run afoul of rules finalized this spring by the Biden-Harris administration.

“Duke’s plan isn’t even compliant with the latest EPA regulations related to greenhouse gas pollution,” David Rogers, deputy director of the Sierra Club’s Beyond Coal Campaign, said in a statement.

Concerns about the Biden-Harris rules, along with doubt that the natural gas plants could be converted to burn carbon-free hydrogen, appeared not to persuade regulators.

“The Commission acknowledges that there are uncertainties and risks associated with new natural gas-fired generation resources, but this is true of all resources,” the panel wrote.

On the contrary, regulators believe Duke can make use of gas plants after the state’s 2050 zero-carbon deadline, even if clean hydrogen doesn’t pan out.

“Accordingly,” the panel said, “the Commission determines that a 35-year anticipated useful life of new natural gas-fired generation and its assumed capital costs are reasonable for planning purposes.”

The greenlight for the gas infrastructure is not absolute, commissioners emphasized in their order, since Duke still must obtain a separate permit for the facilities. But advocates still bemoaned the anticipated impact on customers.

“This order leaves the door open for Duke Energy to stall on carbon compliance in order to develop additional resources, like natural gas, that largely benefit their shareholders over ratepayers,” Matt Abele, the executive director of the North Carolina Sustainable Energy Association, said via text message.

Still, Abele and other advocates acknowledged the plan’s upsides, including its increase in renewables like solar and batteries. The 2022 plan limited those resources to about 1 gigawatt per year; this year’s version increases the short-term annual addition to about 1.7 gigawatts.

Regulators’ decision to bless 2.4 gigawatts of offshore wind by 2034 and call for Duke to complete an “Acquisition Request for Information” by next summer also drew measured praise.

“This order is an overall positive step for offshore wind,” Karly Lohan, North Carolina program manager for the Southeastern Wind Coalition, said in an email, adding, “we still need to see Duke move with urgency and administer the [request for information] as soon as possible.”

With regulators required to approve a new carbon-reduction plan for Duke every two years, advocates are already looking ahead to next year, when the process begins anew.

“Proceedings in 2025 present another chance to get North Carolina back on track to achieving the carbon reduction goals as directed by state law,” Will Scott, Environmental Defense Fund’s director of Southeast climate and clean energy, said in a statement.

“By accelerating offshore wind and solar, the Commission could still set a course for meaningful emissions reductions from the power sector that are fueling the effects of climate change, including dangerous and expensive storms like Hurricane Helene.”

And like Scott, David Neal, senior attorney with the Southern Environmental Law Center, isn’t giving up on the state’s 2030 carbon-reduction deadline, the commission’s latest order notwithstanding.

“We’ll continue to push for the clean energy future that North Carolinians deserve and that state law and federal carbon pollution limits mandate,” he said in a statement.

Nearly a year after Massachusetts regulators laid out a vision for the state’s evolution from natural gas distribution to clean energy use, lawmakers are coalescing around legislation that would start converting principles into policy.

The wide-ranging climate bill includes several provisions that would allow utilities to explore alternatives to gas and empower regulators to place more limits on the expansion and continuation of natural gas infrastructure, changes that supporters say are critical to a successful transition away from fossil fuels.

“This bill is a major first step in empowering [regulators] to do something rather than just rubber stamping the utilities’ plans,” said Lisa Cunningham, co-founder of ZeroCarbonMA.

Natural gas is currently the primary heating source for half the homes in Massachusetts, a number that needs to drop if the state is going to meet its ambitious climate goal of net-zero emissions by 2050, advocates and state leaders say. In 2020, the state department of public utilities opened an investigation into the role natural gas utilities would play in the transition to cleaner energy. In December 2023, the department issued a lengthy order concluding that the state must move “beyond gas” and outlining a broad framework for making the shift.

Lawmakers attempted to start turning these general ideas into binding law earlier this year, but the legislative session closed at the end of July before the Senate and House reconciled the differences between their versions of a climate bill. Legislators returned to work this fall and hammered out an agreement, and the Senate passed the resulting bill last month. The House speaker has said the body will vote when it returns to formal session later this year. The bill is generally expected to pass and be signed into law.

“A lot of people were skeptical we’d get a bill at all, but I’m happy with where this bill ended up,” said Kyle Murray, Massachusetts program director for climate nonprofit Acadia Center. “It shows a step toward that needed urgency.”

At the heart of the bill’s energy transition provisions is a change to the definition of a natural gas utility that allows the companies to also provide geothermal power. Networked geothermal — systems that draw heat from the earth and deliver it to a group of buildings — is widely seen as a promising alternative to natural gas, and both National Grid and Eversource have pilot projects in the works. However, current law prevents the utilities from pursuing such projects without specific authorization from regulators. The climate bill would remove this barrier, making it easier for gas companies to explore new approaches to business.

“The gas utilities deeply need a new business model that can help them step into the future,” said Audrey Schulman, founder of climate solutions incubator HEETlabs. “That allows them to potentially evolve.”

This definition change supports other provisions aimed at slowing the expansion of natural gas use in the state. The bill would end the requirement that natural gas utilities provide service to any customer in their service area who requests it, with few exceptions. Under the new law, utilities could decline these requests when other alternatives are available.

The bill would also allow regulators to consider the impact of emissions when deciding whether to approve requests to expand natural gas service into new communities. In 2023, the state approved a request to bring gas service to the central Massachusetts town of Douglas. Regulators at the time noted that the decision works against the state’s goal of phasing out natural gas, but said the law gave them no choice but to approve the plan. Provisions in the climate bill would untie regulators’ hands in such cases in the future.

“The [Department of Public Utilities] can consider the public interest, including climate, it doesn’t have to say yes to more gas service,” said Amy Boyd Rabin, vice president of policy at the Environmental League of Massachusetts. And the inclusion of geothermal in gas utilities’ definition means “now there’s also something else to offer the customers.”

Another major element of the bill would reform the state’s Gas System Enhancement Plans program, which encourages utilities to repair or replace pipes in the state’s aging and leak-prone natural gas distribution system. Clean energy advocates have often argued that these plans are problematic, investing billions of ratepayer dollars into shoring up a system that is increasingly obsolete. The climate bill would allow utilities to choose to retire segments of pipe rather than fixing them.

“For the first time ever they are able to look at a pipe and say, ‘You know what, this is not worth the cost,’” Murray said. “We don’t want ratepayers shouldering the burden for a lot of stuff that’s not going to be useful in five to 10 years.”

Environmental advocates praised the bill’s gas provisions, and are already focusing on what more there is to be done. Several would have liked to see a more aggressive phasing out of Gas System Enhancement Plans, with a specific end date. Others champion an expansion of a pilot program that allows cities and towns to ban fossil fuel use in new construction and major renovations.

“There is no reason why communities that want to enact this via home rule petition should be restricted from enacting the will of their constituents,” Cunningham said.

In the meantime, advocates are ready to see the climate bill turning into reality.

“There’s a lot of good stuff in there that will do a lot of good for the commonwealth,” Boyd Rabin says.

The UK’s last coal-fired power plant, Ratcliffe-on-Soar in Nottinghamshire, will close this month, ending a 142-year era of burning coal to generate electricity.

The UK’s coal-power phaseout is internationally significant.

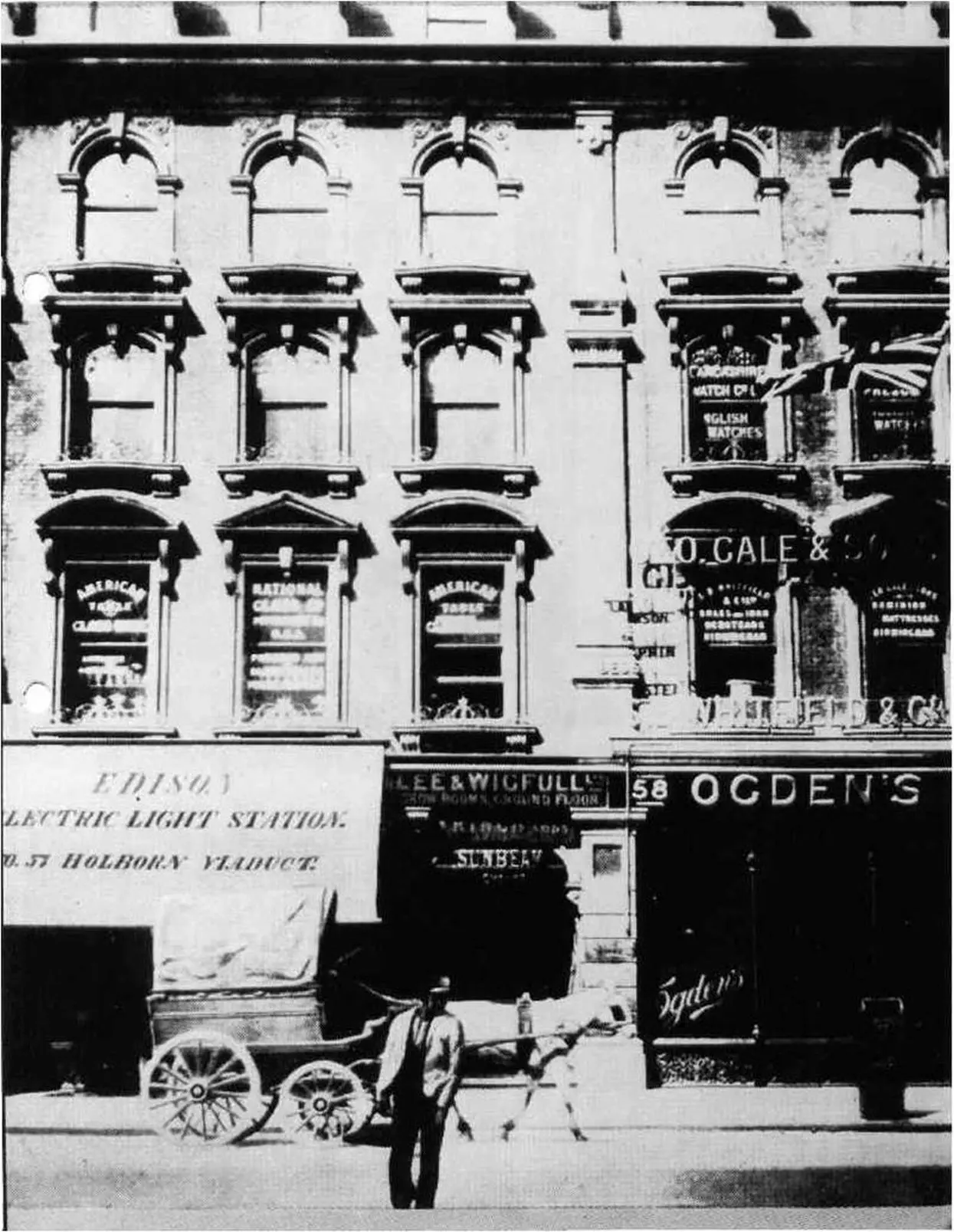

It is the first major economy – and first G7 member – to achieve this milestone. It also opened the world’s first coal-fired power station in 1882, on London’s Holborn Viaduct.

From 1882 until Ratcliffe’s closure, the UK’s coal plants will have burned through 4.6bn tonnes of coal and emitted 10.4bn tonnes of carbon dioxide (CO2) – more than most countries have ever produced from all sources, Carbon Brief analysis shows.

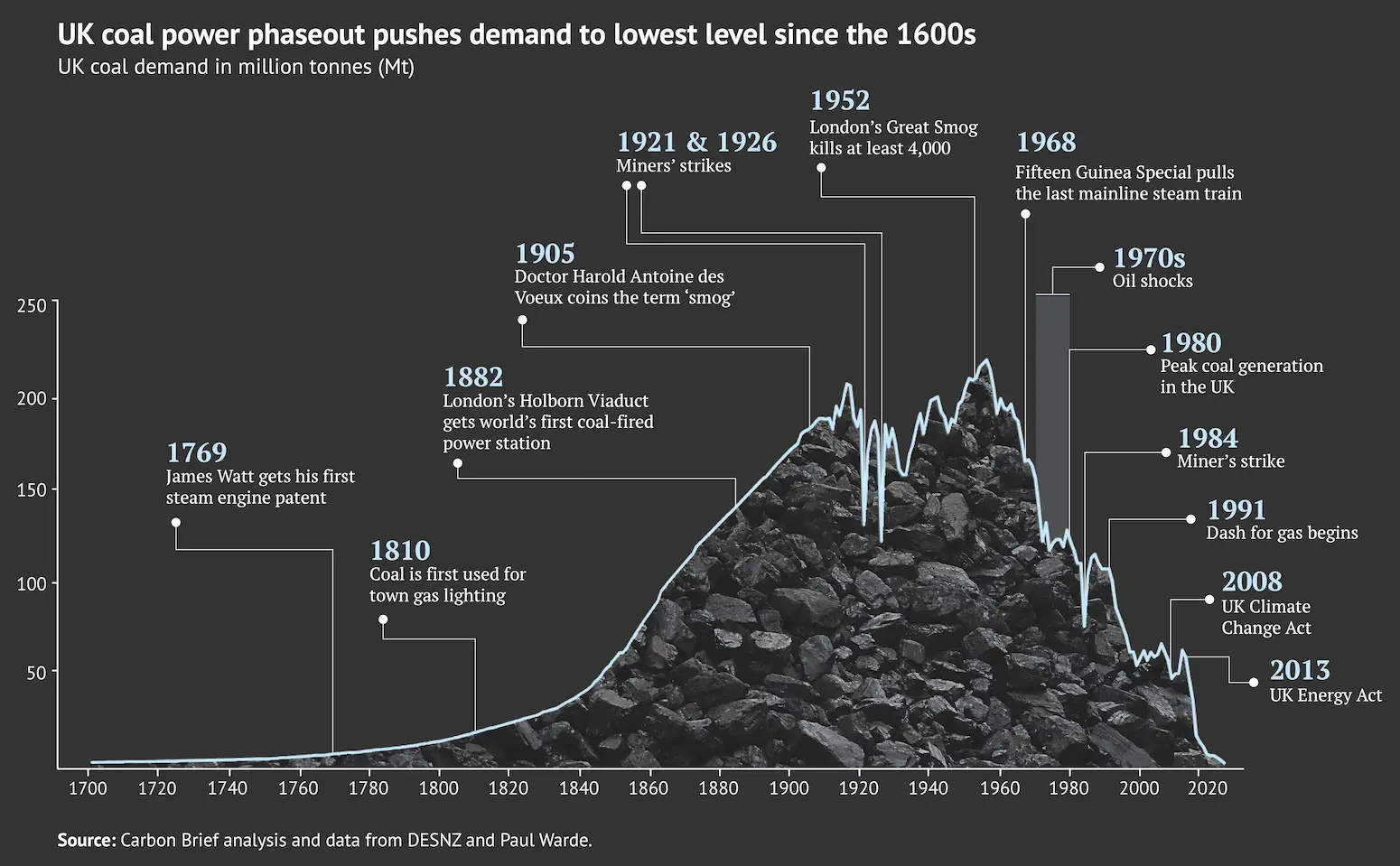

The UK’s coal-power phaseout will help push overall coal demand to levels not seen since the 1600s.

The phaseout was built on four key elements.

First, the availability of alternative electricity sources, sufficient to meet and exceed rising demand.

Second, bringing the construction of new coal capacity to an end.

Third, pricing externalities, such as air pollution and carbon dioxide (CO2), thus tipping the economic scales in favour of alternatives.

Fourth, the government setting a clear phaseout timeline a decade in advance, giving the power sector time to react and plan ahead.

The UK’s experience, set out and explored in depth in this article, demonstrates that rapid coal phaseouts are possible – and could be replicated internationally.

As the UK aims to fully decarbonise its power sector by 2030, it has the challenge – and opportunity – of trying to build another case study for successful climate action.

The UK’s resource endowment has long included abundant coal, which had been used in small quantities for centuries. Coal use for electricity generation only came much later.

Over the centuries, surface coal deposits had been exhausted and mining became a necessity, despite the dangers of subsurface flooding, rock collapse and noxious gases.

The earliest steam engines, in use from around 1700, burned coal to pump water out of mines, enabling deeper coal deposits to be accessed.

These steam engines were very inefficient, but improvements by inventors including James Watt and George Stevenson made the use of coal more economical – and more widespread.

(This effect, whereby greater efficiency reduced costs, which, in turn, raised demand and fueled greater use of coal, despite higher efficiency, became known as the Jevons paradox.)

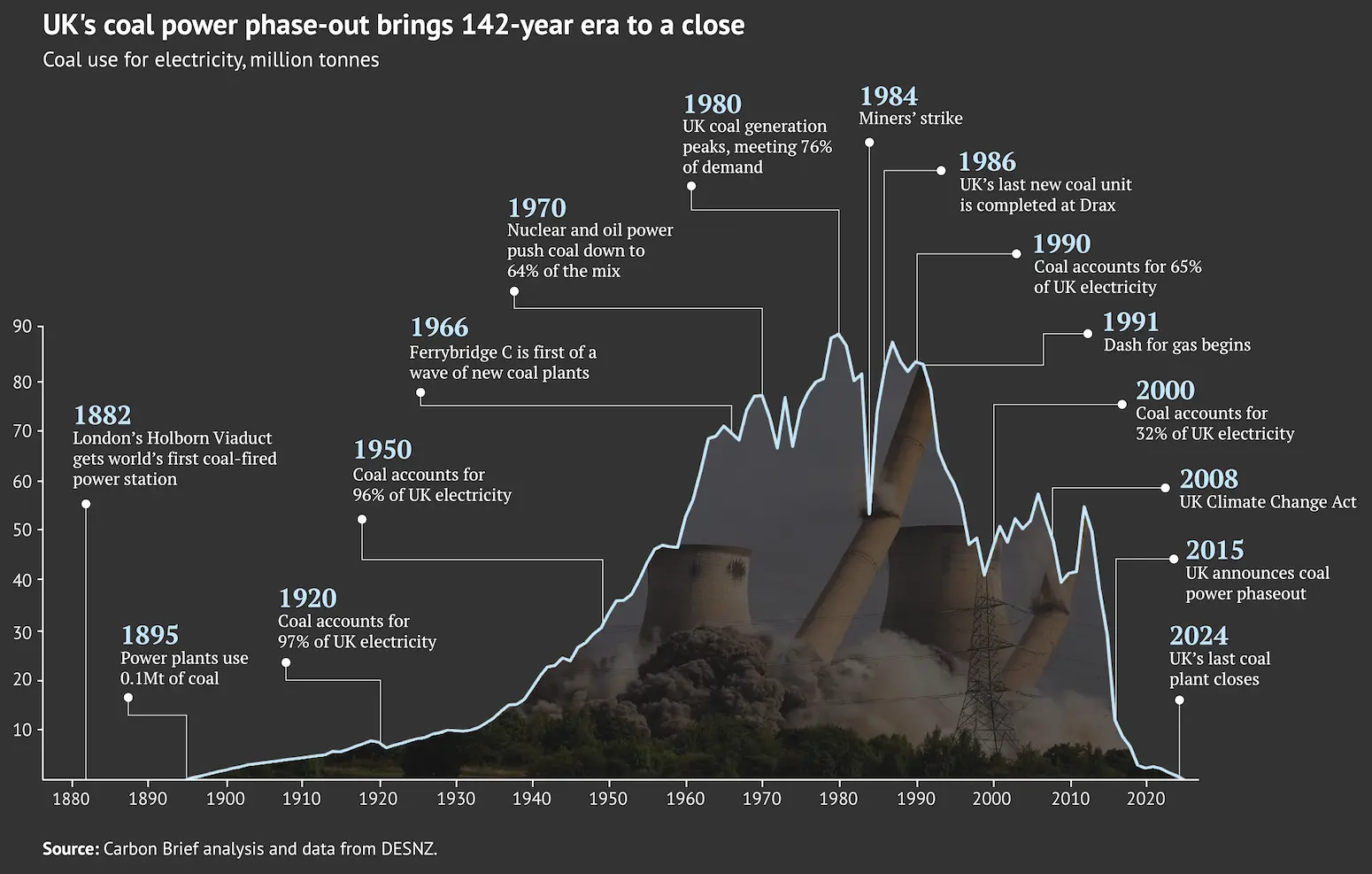

As a result, UK coal use began to surge as shown in the chart below, helping to power the Industrial Revolution, the British empire – and an explosion in global carbon dioxide (CO2) emissions.

Speaking to Carbon Brief, Dr Ewan Gibbs senior lecturer in economic and social history at the University of Glasgow and author of “Coal Country: The Meaning and Memory of Deindustrialization in Postwar Scotland”, says:

“The way the UK’s Industrial Revolution unfolded, coal was absolutely pivotal to becoming the industrial economy that Britain developed in the 19th century. The steel industry was powered by coal. And over the late 18th – and certainly in the first half of the 19th century – Britain became a coal power economy. It was the world’s first coal-fired economy.”

This is before looking at the coal mining industry and its role in the British Industrial Revolution, adds Gibbs, which employed more than a million miners at its peak and shaped the industrial economy of large regions of the country.

In 1810, coal began to be used for town gas for lighting and from 1830 it was used to fuel the expansion of the railways as they snaked across Britain.

It was in 1882 that coal was first used to generate electricity for public use. In January of that year, the world’s first coal-fired power station began operating at Holborn Viaduct in London.

Built by the Edison Electric Light Station company, the “1,500-light” generator, known as Jumbo, supplied electricity for lighting to the viaduct and surrounding businesses until 1886. It was hailed by Edison himself as a success.

These new uses – supplying heat, light and locomotion, in addition to industrial energy – helped drive a steep uptick in the use of coal in the UK. Demand grew more than tenfold from 14.9m tonnes (Mt) in 1800 to 172.6Mt by 1900.

Small coal-fired power plants were being opened around the UK during this period, including the Duke Street Station in Norwich. Opened in 1893, the site provided lighting for the Colman’s mustard factory on Carrow Road and surrounding area.

Despite surging domestic demand, the UK also became the “Saudi Arabia of 1900”: coal was its largest bulk export and it was the biggest energy exporter in the world until 1939.

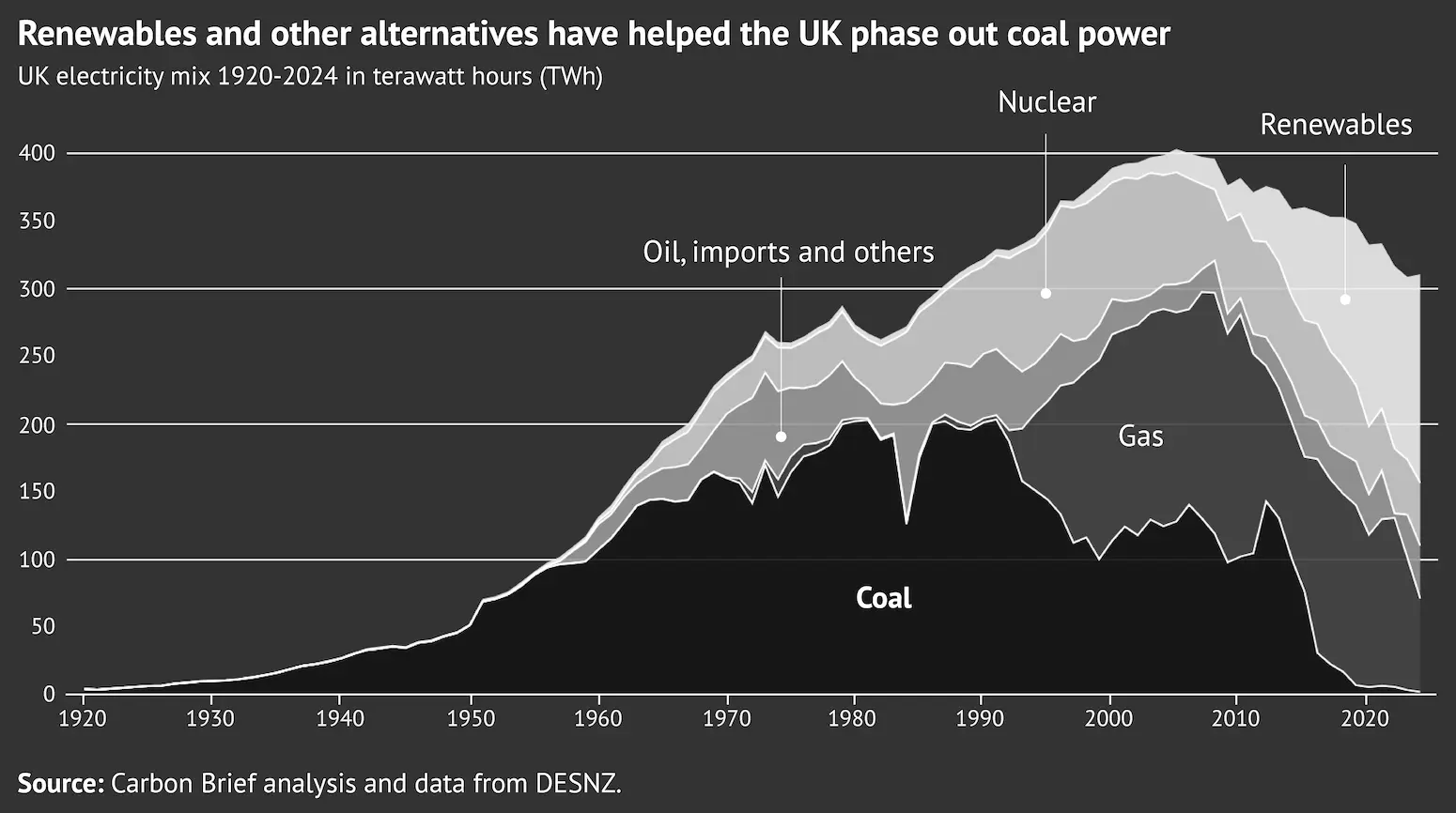

By 1920, the UK was generating 4 terawatt hours (TWh) of electricity from coal, meeting 97% of national demand – the bulk of which came from factories.

It was around this time that the first hydropower plants were also being built in Scotland, although most were used to directly power nearby aluminium plants. As industries such as this continued to grow in the UK, so too did the demand for electricity.

Throughout the first half of the 20th century, the use of coal continued to expand in the UK, despite notable blips driven by miners strikes in the 1920s and the Great Depression between 1929 and 1932.

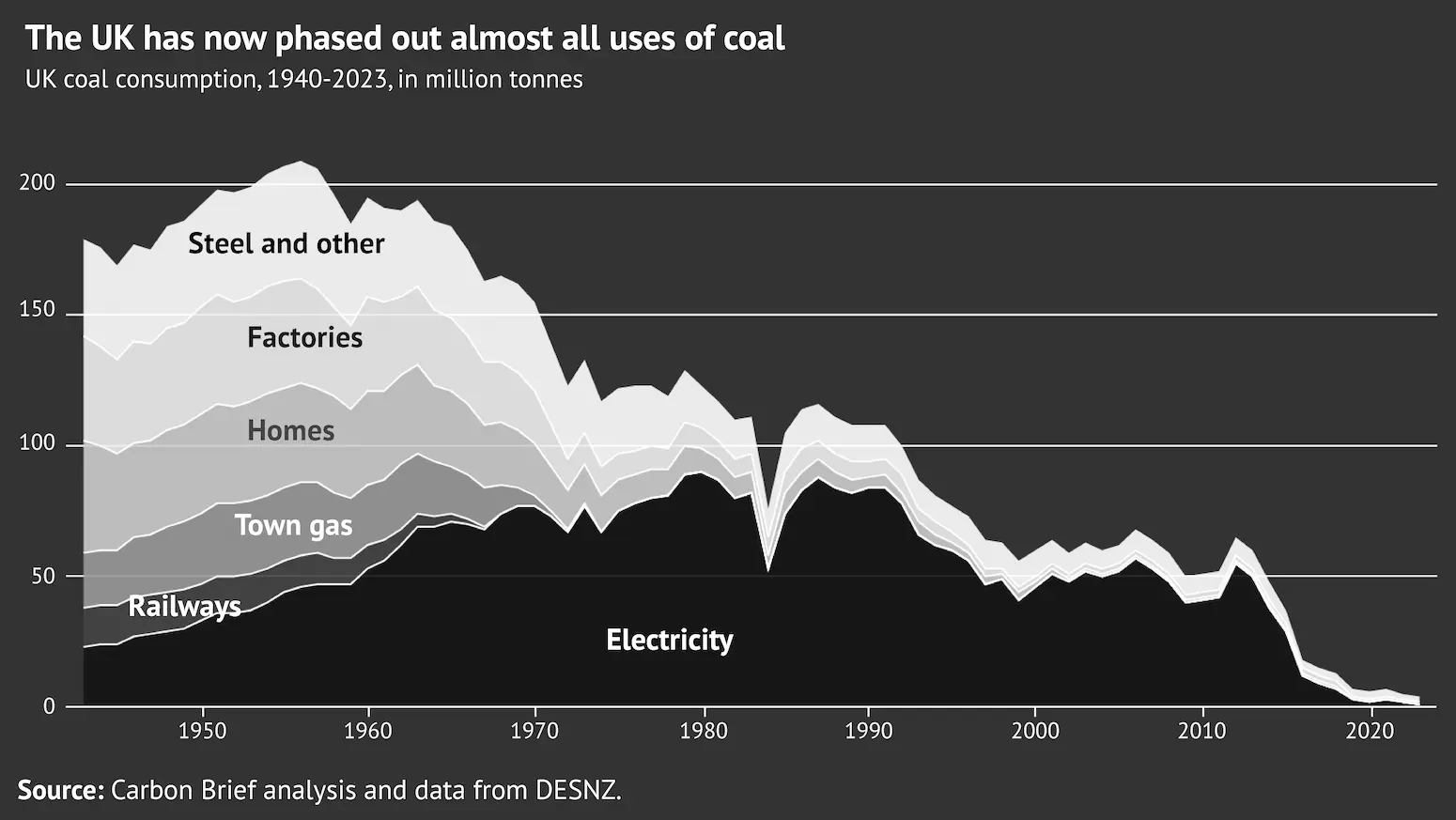

By the time UK coal use had reached its peak of 221Mt in 1956, however, coal power was still only a small fraction of demand. Steelmaking, industry, town gas, domestic heat and the railways dominated, as shown in the chart below.

Over the second half of the 20th century, all of these uses – except power – declined steeply.

Reasons for the decline in UK coal use in this period include the advent of North Sea gas and the end of steam railways, as well as increasing globalisation and deindustrialisation.

The coal mining workforce dropped from more than 700,000 in the 1950s to less than 300,000 by the mid-1970s. However, these losses occurred as part of a fairly “just transition”, as mining jobs were replaced by those in manufacturing, Gibbs says.

After the mine closures that triggered the 1984 strikes, mining jobs fell again to less than 50,000 by 1990. Many former coal mining communities remain impoverished and this period has been cited as a “failed just transition” for coal workers.

Another key factor in the post-war coal decline was that, by the 1950s, the environmental impact of burning coal was becoming too obvious – and dangerous – to ignore.

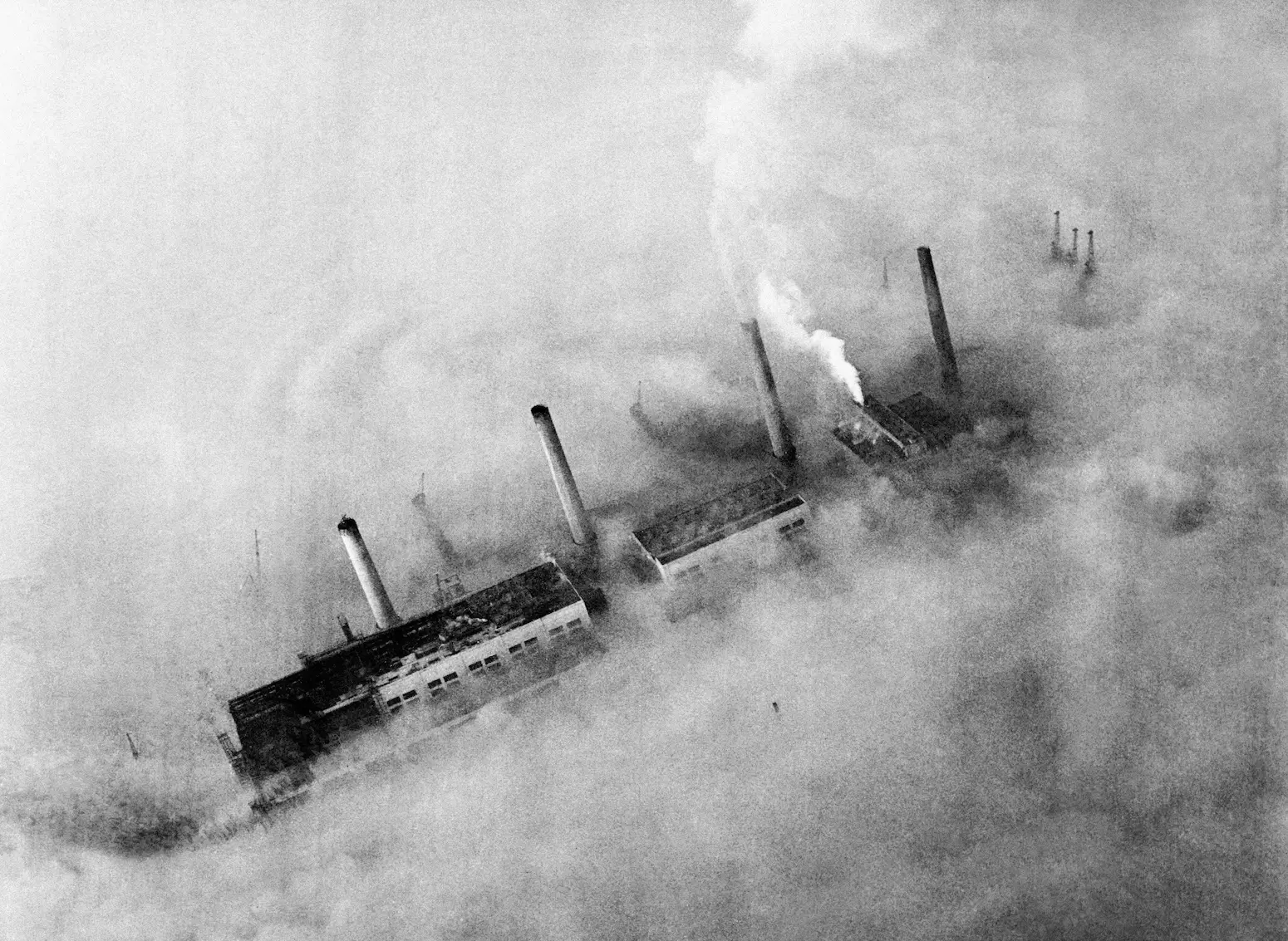

As early as the 1850s, pollution from burning coal in London’s homes and factories had started causing “pea-souper” days – when a greenish fog settled over the city. In 1905, Irish doctor Harold Antoine des Voeux had coined the term “smog” while working in London.

But events came to a head in December 1952. As winter temperatures began to bite, the people of London stoked their coal fires. An anticyclone weather pattern caused cold, still conditions, trapping polluted air over the city.

Smoke from fires mingled with pollution from factories and other sources dotted across London, creating what became known as the “Great Smog”.

Lasting for four days, the fog was up to 200 metres thick, according to the Met Office. Conditions were worst in London’s East End, which was home to a large number of factories powered by coal.

During this period, around 1,000 tonnes (t) of smoke particles, 2,000t of CO2, 140t of hydrochloric acid and 14t of fluorine compounds were emitted per day in London, according to the Met Office. Additionally, “and perhaps most dangerously”, 370t of sulphur dioxide was converted into 800t of sulphuric acid, it adds.

About 4,000 people are known to have been killed by the Great Smog, although it could have been many more. Hospitalisations increased by 48%, instances of asthma grew in exposed children and the city was disrupted for days.

Three years later, parliament responded with the 1956 Clean Air Act. This outlawed “smoke nuisances” or “dark smoke” and set limits for what new furnaces could emit. Laws around emissions were further strengthened in 1968.

The decades that followed saw the use of coal for domestic heating, rail travel and industry continue to decline as cheaper and cleaner alternatives began to take over.

These years also saw a shift away from small coal plants in cities towards large-scale power plants in rural areas, closer to coal mines. While the UK was also pioneering nuclear power, it was not until 1957 that coal’s share of annual electricity generation fell below 90% for the first time.

Between 1960-64, the Central Electricity Generating Board (CEGB) unveiled plans for 10 coal-fired power stations using 500 megawatt (MW) “turbo-generator” units. These projects formed a wave of new coal plants that were opened between 1966 and 1972.

Construction of these projects saw coal capacity climbing to an all-time peak of 57.5GW in 1974. Coal generation peaked a few years later in 1980, at 212TWh, but by this time – with electricity demand rising rapidly – it only made up 76% of electricity supplies, as oil and nuclear power had eroded its market share.

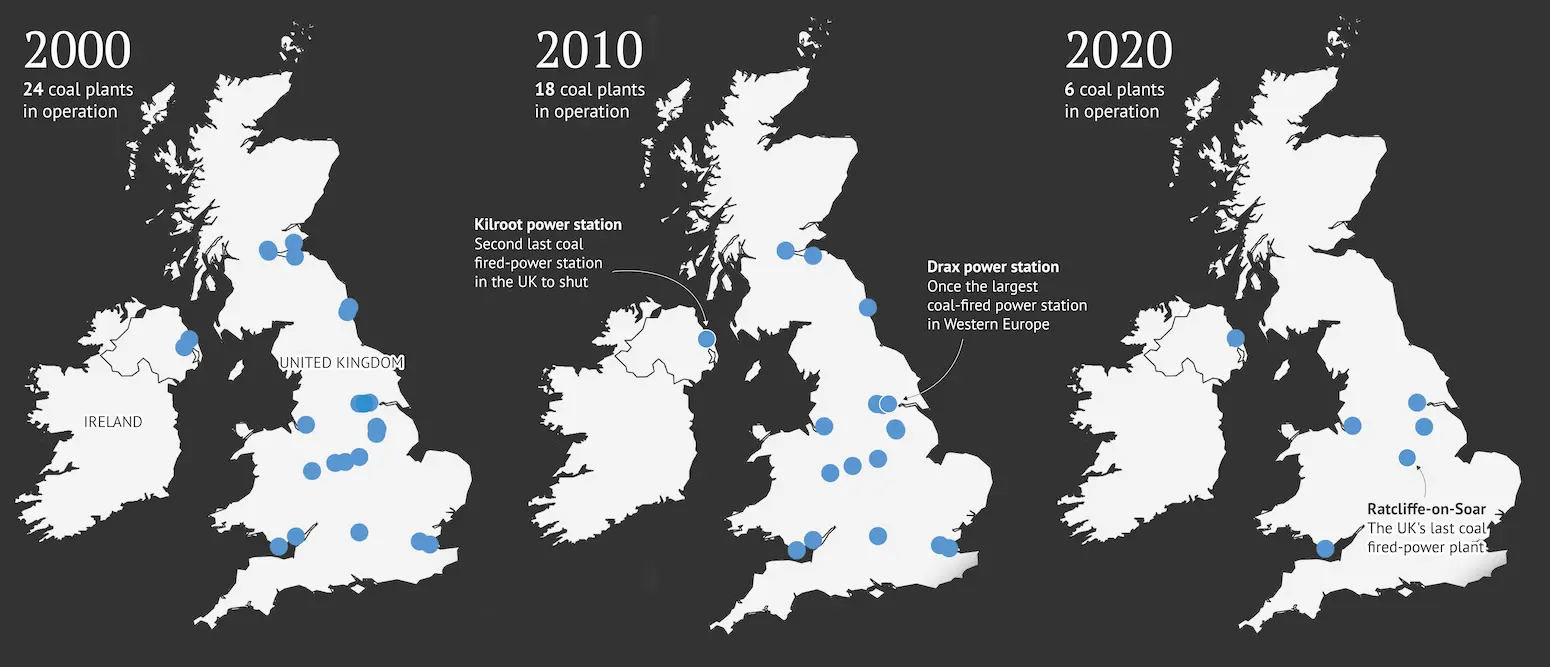

The UK’s last new coal-fired generating capacity was at Drax, which had opened in 1975 as a 2GW plant, but was doubled to 4GW in 1986.

By 1990, despite significant growth in nuclear capacity in the previous decade, coal still made up 65% of the UK’s electricity mix.

The combination of the Clean Air Act, the switch from town gas to North Sea gas, deindustrialisation and globalisation had all helped drive down the use of coal in the second half of the 20th century.

But, as noted above, coal power continued to thrive for much of this period, as alternative sources of electricity generation failed to keep up with rising demand.

As a result, coal generation did not peak until 1980 – and remained at similar levels in 1990.

Then, after a century dominating UK electricity supplies, coal was phased out in two rapid and distinct stages, punctuated by a plateau that lasted more than a decade.

The first stage was the “dash for gas” of the 1990s.

The second stage saw the buildout of renewables, rising energy efficiency and policies to make coal plants pay for their pollution.

From the 1950s, the expansion of nuclear and oil-fired power-plants had begun to erode coal’s share of the UK electricity mix. Still, coal-fired electricity generation continued to grow throughout the 1960s and 1970s as coal-fired power stations were built up and down the country. This included Ratcliffe-on-Soar, the UK’s last operating coal-fired power plant, which was commissioned in 1968 by the CEGB.

While gas had been discovered in the North Sea in the 1960s, its large-scale use for electricity generation was ignored and restricted for many years.

With the exception of 1984 – when oil power helped keep the lights on during the miners’ strike – coal generation continued to hold steady through the 1980s.

By the end of that decade, however, coal power was about to enter its first stage of decline.

Amid rising concern about acid rain, the EU passed the 1988 Large Combustion Plant Directive (LCPD), requiring reductions in sulphur dioxide emissions. Coal plants were a major source, with abatement technology added to their running costs.

At the same time, ”combined cycle” gas turbine technologies were advancing and gas prices were falling, making gas not only cleaner, but also cheaper than coal.

The ensuing dash for gas within the newly privatised electricity sector saw coal-fired generation roughly halve in a decade. It fell from more than 200TWh and 65% of the total in 1990 to just over 100TWh and 32% in 2000 – with gas power going from near-zero to nearly 150TWh over the same period.

Following the turn of the century, the UK’s coal power entered a period of stagnation, with its output rising, then falling and rising again, in response to the ebb and flow of gas prices.

In 2000, the UK’s now-defunct Royal Commission on Environmental Pollution had published a report on energy and the “changing climate”. It called on the government to cut UK greenhouse gas emissions to 60% below 2000 levels by 2050, including via a “rapid deployment of alternative energy sources” to replace fossil fuels.

By the time of the 2003 energy white paper, the “60% by 2050” target was government policy, as was a goal for 10% of electricity to be renewable by 2010, supported by a “renewables obligation”. New nuclear was “not rule[d] out” – but it remained uncertain.

Yet the 2003 white paper also left the door open to “cleaner coal” using carbon capture and storage (CCS). And it proposed government-backed investment in new coal reserves.

It was to take another decade, including a range of new policy developments, a major protest movement and an unexpected – but highly significant – decline in electricity demand, before UK coal power would enter the second stage of its phaseout.

One such policy development was the 2005 entry into force of the EU Emissions Trading System (EUETS), the world’s first major carbon market. It was initially ineffective – carbon prices crashed, particularly in the wake of the 2008 financial crisis – but the EUETS established the principle that polluting power plants should pay for their CO2 emissions.

Another notable policy was the 2001 update to the EU’s LCPD, which set out tighter limits on air pollution from power plants and came into force in 2008.

Many of the coal-fired power plants in the UK were old by this point and opted to use a “derogation” (exemption) that allowed continued operation until 2015, without the need to invest in pollution control equipment, if they only operated for a limited number of hours.

While this sealed the fate of a raft of older plants, the prospect of new coal-fired capacity in the UK was very much still on the agenda at this point.

In late 2007, the “Kingsnorth six” scaled the chimney of an existing coal plant in Kent to protest against plans for a new station at the site. In January 2008, the local council approved the plans for what would have become the UK’s first new coal plant for 24 years.

In October 2008, the UK passed the Climate Change Act, including a legally binding target to cut greenhouse gas emissions to 60% below 1990 levels by 2050 – later strengthened to 80% and then, in 2019, to “net-zero”.

Sean Rai-Roche, policy advisor at thinktank E3G, tells Carbon Brief that the Act, as the first legally binding climate goal set by a country, was a “seminal moment” in the UK’s journey, including its coal phaseout.

By 2009, then-energy and climate secretary Ed Miliband – now secretary of state for energy security and net-zero – announced that no new coal plants would be built in the UK without CCS.

“The era of new unabated coal has come to an end,” Miliband stated at the time.

Yet the Labour government continued to back new coal with CCS, describing it as part of a “trinity” of low-carbon electricity sources along with new nuclear and renewables.

It was only towards the end of 2009, when developer E.On postponed its Kingsnorth plans, that protestors were able to claim their “biggest victory” for the UK climate movement.

The Kingsnorth plant was formally cancelled the following year and no new coal projects were ever built again in the UK, paving the way for an early phase out as old plants retired.

(In contrast, countries including the US and Germany built a wave of new coal capacity around 2010, locking themselves in to continued use of the fuel for longer periods.)

After 2010, with no new coal plants built in the UK and with many older sites set to close rather than making costly upgrades to meet tighter air pollution rules, coal power was primed for the second stage of its phase out – but not before alternative generation was available.

The 2013 Energy Act formalised the end of unabated coal power with an emissions performance standard (EPS). This set a limit of 450g of CO2 per kilowatt hour for new power plants – around half the emissions of unabated coal.

Dr Simon Cran-McGreehin, head of analysis at thinktank the Energy and Climate Intelligence Unit (ECIU), tells Carbon Brief that the combination of air-pollution rules, the cost of CCS and carbon pricing has made ongoing coal generation “uncompetitive”. He says:

“Ongoing coal power simply isn’t an option, as it would have such high costs…that it would be uncompetitive with even gas and nuclear, let alone new renewables.”

The 2013 Energy Act also revived plans for new nuclear, leading to the construction of Hinkley Point C in Somerset, and created “contracts for difference” to support the expansion of low-carbon generation.

Renewable generation went on to double in the space of five years, from around 50TWh in 2013 to 110TWh in 2018. Renewables are on track to generate more than 150TWh in 2024.

The coalition government also introduced the “carbon price floor” in 2013, which added a top-up price to CO2 emissions from the power sector and tipped the scales in favour of gas over coal.

This additional carbon price had a “significant effect” on UK coal power, according to thinktank Ember, helping drive a sharp reduction in generation over the years that followed.

Coal dropped from nearly 40% of the UK electricity mix in 2012 to 22% in 2015.

In addition to the growth of renewables, an additional factor allowing the rapid phaseout of UK coal generation has been the fall in electricity demand since 2005.

Indeed, by 2018, demand had fallen to levels not seen since 1994, saving some 100TWh relative to previous trends – equivalent to the output of four Hinkley Point Cs.

Electricity demand has declined thanks to a combination of energy efficiency regulations, LED lighting and the offshoring of some energy-intensive industries.

The rapid pace of progress meant that, by 2015, then secretary of state for energy and climate change Amber Rudd was able to announce a target to phase out coal by 2025.

Speaking at the Institution of Civil Engineers, Rudd said:

“It cannot be satisfactory for an advanced economy like the UK to be relying on polluting, carbon-intensive 50-year-old coal-fired power stations. Let me be clear: this is not the future.”

The following year, in 2016 – after the last plant closures due to the EU’s LCPD – coal power dropped precipitously to just 9% of annual electricity generation.

That year also witnessed the first hour with no UK coal power since the Holborn Viaduct plant had opened in 1882. This was followed in 2017 by the first full day without coal power, in 2019 by the first week without the fuel and, in 2020, by the first coal-free month.

The coal phaseout target was then brought forwards in 2021 to October 2024, with just 1.8% of the electricity mix having come from coal in 2020.

Coal plants continued to shutter throughout this period, as shown in the maps below. SSE’s last coal-fired power station, Fiddler’s Ferry, and RWE’s Aberthaw B station closed in March 2020. Drax’s two remaining coal units and EDF’s West Burton A all closed in March 2023.

(Four of the six coal units at Drax have been converted to burn biomass – mostly wood pellets imported from North America – with uncertain climate impacts. It generates around 14TWh of electricity per year from these units, roughly 4% of the UK total.)

Then, in late 2023, the UK’s second-last coal-fired station – Kilroot in Northern Ireland – stopped generating electricity from coal, leaving just one plant remaining.

These closures left Ratcliffe-on-Soar as the only operating coal-fired power station in the UK in 2024, with coal having met just over 1% of demand in 2023.

On 28 June 2024, the last coal delivery to Ratcliffe took place, a “landmark moment” in the country’s coal journey. The shipment of 1,650 tonnes of coal was only enough to keep it running for a matter of hours.

At full capacity, the 2GW Ratcliffe would have needed roughly 7.5Mt of coal each year, the burning of which would have produced around 15MtCO2.

Ratcliffe’s closure by 1 October will bring to an end 142 years of coal power in the UK. And, contrary to scores of misleading headlines over the years, the lights have stayed on.

Remarkably, the UK’s coal power phaseout – as well as the closure of some of the country’s few remaining blast furnaces at Port Talbot in Wales and Scunthorpe in Lincolnshire – will help push overall coal demand in 2024 to its lowest level since the 1600s.

In total, coal-fired power stations in the UK will have burned through some 4.6bn tonnes of coal across 142 years, generating 10.4bn tonnes of CO2, Carbon Brief analysis shows.

If UK coal plants were a country, they would have the 28th-largest cumulative fossil-fuel emissions in the world. This would mean greater historical responsibility for current climate change from those coal plants than the likes of entire nations such as Argentina, Vietnam, Pakistan or Nigeria.

The UK’s electricity system today looks dramatically different to even just a few decades ago, with renewables increasingly dominating the generation mix.

In 2023, renewables set a new record by providing 44% of the country’s electricity supplies, up from 31% in 2018 and just 7% in 2010. Their output is set to increase from around 135TWh in 2023 to more than 150TWh this year, Carbon Brief analysis shows.

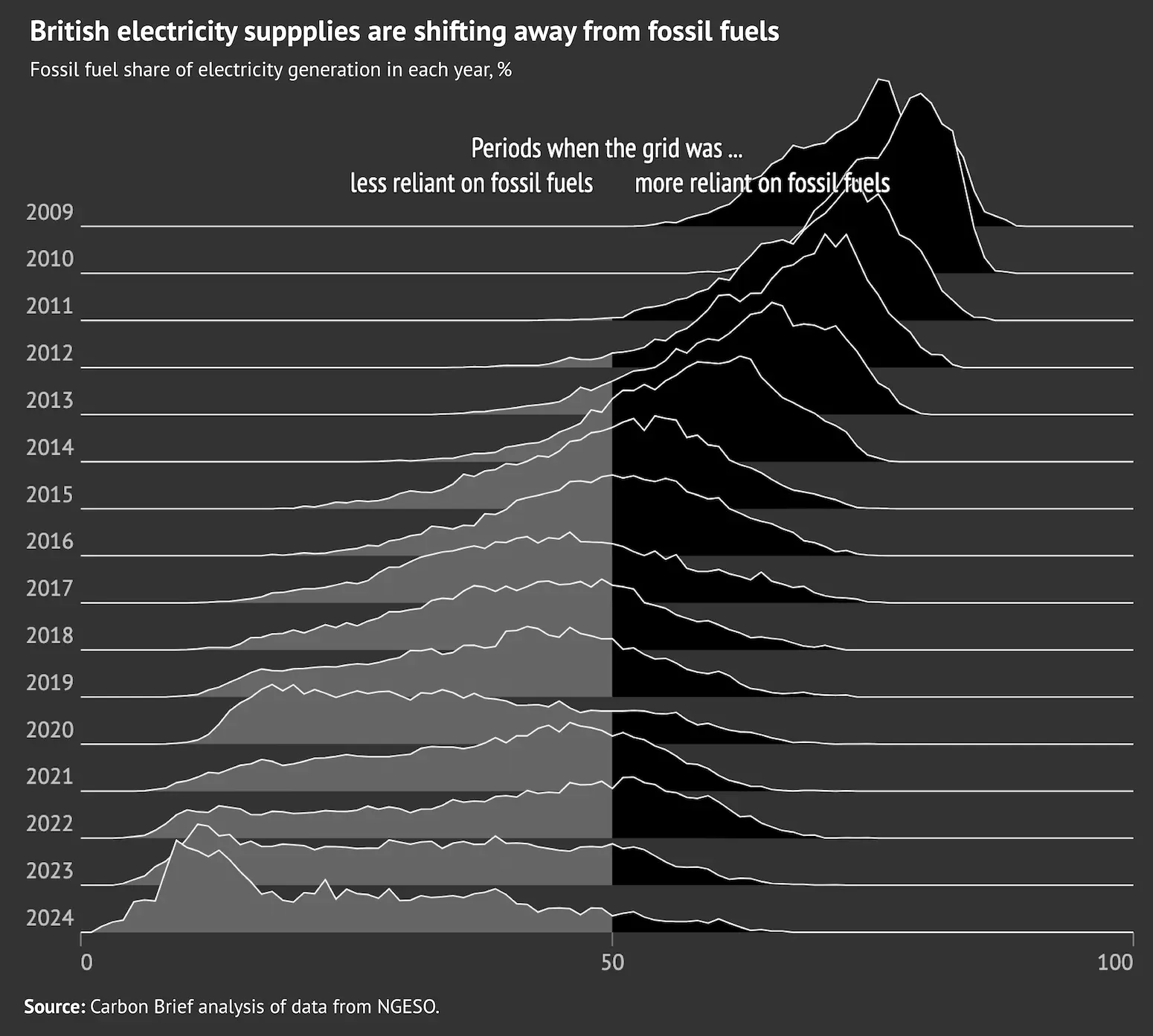

By comparison, fossil fuels made up just a third of supplies, with a record-low 33% of the electricity mix, of which coal was a touch over 1%.

This decrease of just under 20% brought fossil fuel supplies down to 104TWh, the lowest level since 1957, when 95% of the mix came from coal.

The changing makeup of the UK’s electricity mix over the past century is shown in the figure below. Notably, while oil, nuclear and gas have each played important roles in squeezing out coal power, it is now renewables that are doing the heavy lifting.

Indeed, all other sources of generation are now in decline: nuclear as the UK’s ageing fleet of reactors reaches the end of its life; and gas, as well as coal, as renewables expand.

In 2024, renewables have continued to take up an increasing share of the electricity mix, with Carbon Brief analysis of year-to-date figures putting them on track to make up around 50% of supplies for the first time ever.

The growth of renewable electricity in the UK’s electricity mix has been “instrumental in driving coal out”, E3G’s Rae-Roche tells Carbon Brief:

“Crucially, coal hasn’t been replaced by other fossil fuels, gas generation fell from 46% in 2010 to 32% in 2023. [Carbon Brief analysis suggests gas will fall again, to around 22% of electricity supplies in 2024.] So, on a gigawatt basis, we’ve replaced the ‘firm’ coal capacity with gas, but on a gigawatt hour basis – which is what matters to emissions – we stopped using as much [of either] coal or gas because of the renewables on the system.”

For one hour in April, for example, the share of electricity coming from coal and gas fell to a record-low 2.4%, Carbon Brief analysis revealed.

This pressages the first-ever period of “zero-carbon operation”, when the electricity system will be run without any fossil fuels – a moment that the National Energy System Operator (NESO) expects to reach during at least one half-hour period during 2025.

In 2009, the lowest half-hourly fossil-fuel share was 53%. The first half-hour period where there was less than 5% fossil fuels only happened in 2022, Carbon Brief’s analysis found.

Last year, there were 16 half-hour periods with less than 5% fossil fuels and more than 75 periods of such in the first four months of this year.

This switch has been enabled by the swift growth of renewable technologies, in particular wind, which now vies with gas month-to-month as to the biggest source of electricity in the country. In the first quarter of 2024, wind contributed more electricity than gas generation for the second quarter in a row.

After becoming the first major economy to phase out coal generation, the UK is looking to go one step further by fully decarbonising its power supplies by 2030.

Under the previous Conservative government, the UK was targeting a fully decarbonised power sector by 2035. The newly elected Labour government brought this forward to 2030.

At the same time, the power sector will need to start expanding in order to meet demand from sectors such as transport and heating, as they are increasingly electrified.

Former Climate Change Committee (CCC) chief executive and now head of “mission control” for the government’s 2030 power target Chris Stark told a central London event in mid-September that he saw the goal as “possible”, but “challenging in the extreme”.

Noting scepticism that clean power by 2030 is achievable, he said that it was nevertheless a real goal and not an aspirational “stretch target”.

Stark added that many people had been similarly sceptical of the UK’s ability to phase out coal power by this year – and that that scepticism “really motivates me”.

Electricity demand in the UK is expected to increase by 50% by 2035, according to the CCC.

Meeting this growth at the same time as phasing out unabated gas will require a very large increase in renewable generating capacity, as well as supporting systems to ensure the grid can run securely on predominantly variable generation from wind and solar.

At the event, Stark noted that clean power by 2030 was a “smaller target” than for 2035 because it would come before widespread electrification of heat and transport.

Even so, meeting the goal would require unabated gas power to be phased out within six years, from its current share of around 22%. This would be roughly twice as fast as the UK has phased out coal, from 39% in 2012 to zero in 2024, as the chart below shows.

In order to meet its 2030 target and wider UK climate goals, the Labour government has pledged to double onshore wind capacity, treble solar and quadruple offshore wind.

The expansion of renewables is continuing to be supported by the government’s “contracts for difference” (CfD) scheme. The latest allocation round wrapped up earlier this month and secured contracts for 131 projects, with a total capacity of 9.6GW.

While many welcomed the results as a boost to the renewable pipeline in the UK, others highlighted the need to ramp up capacity in the coming years.

Analysis by trade association Energy UK found that the next CfD auction would need to secure four times more new capacity in order for the UK to reach its targets.

The Labour government is also backing new nuclear projects, CCS and a “strategic reserve of gas power stations” to guarantee security of electricity supplies.

According to a 2023 report from the CCC on how to meet the then-2035 power-sector decarbonisation target, renewables were expected to make up around 70% of generation in 2035, with nuclear and bioenergy contributing another 20% and the final 10% coming from flexible low-carbon sources, including energy storage, CCS or hydrogen turbines.

(A September 2024 report from the International Energy Agency sets out the “proven measures” that can be taken to integrate growing shares of variable wind and solar into electricity grids, while maintaining system stability. It says: “Successful integration maximises the amount of energy that can be sourced securely and affordably, minimises costly system stability measures, and reduces dependency on fossil fuels.”)

Since taking office, the Labour government has asked the Electricity System Operator (ESO, soon to become the National Energy System Operator NESO) to provide “practical advice” on how to reach the “clean power by 2030” target.

Stark told the event that he expected this advice to show that 2030 was unachievable under the current policy and regulatory regime. He said that, by the end of the year, the government would publish a paper setting out the policies that would be needed.

After 142 years of near-continuous electricity generation from coal, the closure of Ratcliffe-on-Soar is truly the end of an era for the UK.

Moreover, there is an obvious symbolism around the UK, home to the world’s first-ever coal-fired power station in 1882, becoming the first major economy to phase out coal power.

Perhaps because of its status as the birthplace of the Industrial Revolution and as the world’s first “coal-power economy”, the UK’s coal phaseout is also viewed internationally as an “inspiring example of ambition”, says COP29 president-designate Mukhtar Babayev.

Beyond mere symbolism, the UK’s coal phaseout also matters in substantive terms, because it shows that rapid transitions away from coal power are indeed possible.

Coal’s share of UK electricity generation halved between 1990 and 2000 – and then dropped from two-fifths of supplies in 2012 to zero by the end of 2024.

This progress hints at the potential for other countries – and indeed the whole world – to replicate the UK’s success and, in so doing, making a major contribution to climate action.

Already Belgium, Sweden, Portugal and Austria have phased out coal-powered generation, and increasingly countries around the world are announcing targets to follow-suit. This includes the G7 announcing in May plans to phase out unabated coal by 2035.

The world’s roughly 9,000 coal-fired power plants account for a third of global emissions, notes IEA chief Fatih Birol. And pathways that limit global warming to 1.5C or 2C include very rapid reductions in CO2 emissions from coal overall – and coal-fired power, in particular.

Indeed, unabated coal-fired power stations have been singled out for attention by the Intergovernmental Panel on Climate Change, the IEA and the UN.

Despite this attention, some 604GW of new coal power capacity is still under development, with the vast majority located in just a handful of countries, including China and India.

In developed countries, three-quarters of coal-fired power plants are on track to retire by 2030, according to the Powering Past Coal Alliance (PPCA). But, globally, 75% of operating coal capacity still lacks a closure commitment, it says.

As other countries look to retire their coal fleets and move away from the fuel, the UK can be used as a case study of a successful phaseout.

There are four key elements that enabled the UK phaseout:

Illustrating each of these elements in turn, on the first point, alternative sources of electricity generation in the UK were initially insufficient to cut into coal power output.

Oil and nuclear from the 1950s onwards eroded coal’s share of electricity generation, but were not sufficient to meet rising demand, meaning coal output kept growing.

In contrast, gas power plants were built so rapidly in the 1990s that they exceeded demand growth and pushed coal generation into decline. Similarly, the rapid growth of renewables after 2010, combined with declining demand, was key to the UK’s coal phaseout.

On the second point, the UK did not build any new coal plants after 1986, partly as a result of protests and political action in the 2010s.

Speaking to Carbon Brief Daniel Therkelsen, campaign manager at campaign group Coal Action Network, says the end of coal-fired power was a “historic moment”, adding that it was “a huge win for the UK public…particularly [those] who spent countless hours campaigning”.

The fact that the UK did not build new coal plants meant there were no recently built assets – with associated economic interests – needing to be retired early for a phaseout.

Moreover, the UK’s existing coal-power fleet was reaching the end of its economic lifetime.

The fact that there were few UK coal mining jobs remaining after the 1980s removed another interest group, that might have stood in the way of the coal power phase out. (In contrast, “influential…coal corporations and unions” have slowed coal’s decline in Germany.)

In terms of externalities, a series of UK and EU policies and regulations covering air pollution and carbon pricing helped tip the scales against coal power.

By making coal plants pay for pollution control equipment, CCS infrastructure or CO2 emissions permits if they wanted to stay open, these policies changed the economic calculus in favour of alternative sources of electricity generation.

Finally, the UK government’s 2015 pledge to phase out unabated coal sent a clear signal to the electricity sector. It allowed decision-making to proceed in the full knowledge that coal plants would need to close, that plant operators would need to diversify their portfolios rather than investing in continued coal-plant operation, and that the sector as a whole would need to ensure alternatives were in place to maintain reliable electricity supplies.

E3G’s Rae-Roche highlights the long-term political goal of coal phaseout as the starting point for successful implementation. He explains:

“You need to set long-term goals and have policy stability about where you want to get to from there. Once you’ve got that established, you think about the legislation that’s required to incentivise clean and move away from fossils. What support needs to be delivered to the clean industry, how that support needs to be managed in terms of the power system and what the power system needs to actually deliver it.”

Similarly, Frankie Mayo, senior energy and climate analyst at Ember, tells Carbon Brief that clear political commitment and policies are key. He says:

“The biggest lesson is that, once the commitments and policies are clear, then rapid, large-scale clean power transition is possible, and it lays the groundwork for future economy-wide decarbonisation.”

As the UK embarks on its next major challenge in the power sector – targeting clean power by 2030 – it has another opportunity to provide a successful climate case study to the world.

Data analysis by Verner Viisainen.

Graphics and design by Joe Goodman.

Even as North Carolina continues to weaken its building energy conservation codes, a new federal rule is poised to spur the construction of thousands of energy-efficient starter homes in the state each year.

Adopted earlier this spring, the measure requires homes with certain federally-backed mortgages to meet the latest guidance for insulation thickness, window quality, and other energy-saving features — a major improvement over the state’s 2009-era floor for new residential construction.

The rule is expected to impact more than 1 in 10 new home sales in North Carolina, mostly by lower-income and first-time homebuyers. Government studies show they will pay more for improved efficiency but reap immediate cash-flow benefits from lower monthly utility bills.

“The requirements are essential for protecting low-income homebuyers and renters,” said Lowell Ungar, federal policy director of the American Council for an Energy-Efficient Economy, “lowering their energy bills, giving them more comfortable and healthier homes, and protecting them in the climate transition.”

The impact extends beyond North Carolina and will lift standards in several states where lawmakers and industry lobbyists have pushed back against energy-saving building code updates.

Ungar and his colleagues are also working to extend the requirements to the independent regulator of Fannie Mae and Freddie Mac. If they succeed, a large majority of new homes in North Carolina could be built to modern energy-savings standards — even though a 2023 state law prevents any major code updates until the next decade.

Rob Howard, who builds sustainable homes in the state’s foothills, fought against the law and now serves on the state’s Building Code Council.

“It’s the first feeling of hope that I’ve had for North Carolina since last year,” he said.

Reducing energy waste in buildings is a critical component of the clean energy transition. The most cost-effective way to do so is at the point of construction, especially in rapidly-growing North Carolina, where some 90,000 new homes are built each year, about two-thirds of them single-family units.

Yet the powerful home construction lobby has long resisted stronger requirements for energy-saving features in residential construction, influencing the state legislature, where it is a major campaign donor, and until recently, the state’s Building Code Council, a citizen commission.

Thus, while model codes are updated every three years, North Carolina’s rules remain outdated. Though the council was poised last year to bring the code in line with 2021 guidelines, lawmakers backed by developers intervened to circumvent the update, overriding a veto from Gov. Roy Cooper, a Democrat.

This year, the Republican-led legislature relaxed insulation requirements and made other changes to the building code that many experts, including the state fire marshals’ association, argued would make homes less safe. Again, Cooper vetoed the measure, and in a vote last week, lawmakers overrode him.

“The General Assembly has let the homebuilding industry make a quick buck at the expense of North Carolina families who will pay more every month in home energy costs,” Drew Ball, Southeast campaigns director at Natural Resources Defense Council, said in a statement after the vote. “This law rolls back North Carolina’s energy building codes and passes the costs on to consumers.”

But state building codes aren’t the only policies that can influence home construction.

The federal government plays a huge role in promoting homeownership by guaranteeing loans for borrowers who can only make a small down payment or may otherwise risk default.

In 2007, a sweeping energy law adopted under the George W. Bush administration required any new home purchased with backing from the Department of Housing and Urban Development or the Department of Agriculture to meet the latest model code for energy efficiency.

It wasn’t until 2015 that the Obama administration tied the loans to the 2009 model energy efficiency code. The Trump administration took no action.

The Biden-Harris administration picked up the torch last year, beginning an examination to make sure the latest model codes would bring more benefits than costs. In May of this year, officials concluded that the 2021 standards wouldn’t negatively affect the affordability and availability of housing.

“As a result of the updated energy standards, energy efficiency improvements of 37% will cut energy costs by more than $950 per year, saving homeowners tens of thousands of dollars over the lifetime of the home,” a press release from the Department of Housing and Urban Development said.

Similarly, last year an independent government lab found that the more stringent standards will add about $5,000 to the cost of the average North Carolina home, but generate a positive monthly cash flow instantly in the form of lower utility bills.

About 1 in 10 new single-family home loans per year are backed by the Department of Housing and Urban Development or the Department of Agriculture, according to the federal officials.

The Department of Veterans Affairs must update its lending rules to match those of HUD and USDA, impacting another 3% to 5% of newly built homes, Ungar estimates.

Howard, who’s building a small collection of super-efficient homes in Granite Falls, says just one of the 11 cottages so far is being financed with a loan that would be affected by the new rule.

“As a small builder who’s focused on attainable housing, I’m going to assume that a certain percentage of my buyers will qualify for the USDA loan programs,” he said. “And so of course, I want them to have the ability to participate in those. But I’ve already made the decision to build to zero-energy ready, which is currently based on the 2021 [model code]. I’m already there.”

The bigger impact of the new rule will be on large, multi-state, multi-regional builders who focus on starter homes, Howard said. “Those kinds of builders don’t want two different levels that they’re building to. They would rather have one that simplifies their entire construction process.”

With the new rule, then, builders can either adhere to the latest energy efficiency standards so that potential buyers can qualify for federal backing on their loans — or not.

“Let’s set the bar as high as possible,” said Howard, “and then builders get to choose.”

If multi-state builders choose to build all of their homes to the 2021 model code, the rule’s impact could extend beyond the roughly 15% of new stock estimated by government officials and advocates.

If advocates succeed in getting the Federal Housing Finance Agency, the regulator of Fannie and Freddie, to adopt the same standards, the effect would be even greater: the two companies ultimately end up buying over half of mortgages in the country.

“Now you’re talking about 70% of the loans in this country,” Howard said. “So that’s obviously a much broader impact.”

As they have in North Carolina, the national builder lobby claims the energy efficiency standards will add tens of thousands of dollars to construction costs. They oppose the rule that’s already finalized for the Departments of Agriculture, Housing and Urban Development, and Veterans Affairs, and they object to extending the requirements to Fannie and Freddie.

“If Fannie and Freddie were forced to comply with the 2021… mandate,” Missouri builder Shawn Woods told Congress this spring, “this would become a de facto national standard and be a massive blow to housing affordability.”

Unless Republican presidential nominee Donald Trump wins this November, the finalized rule is safe for now, advocates believe. As for the broader requirements on Fannie and Freddie, the director of the Federal Housing Finance Agency said it would study the matter and issue a decision by the end of June.

“Obviously, they did not do that,” Ungar said.

OIL & GAS: Data show two now-defunct companies abandoned 551 oil and gas wells in Colorado last year, leaving them to the state to plug and reclaim. (CPR)

ALSO: New Mexico regulators reject dozens of proposed oil and gas wastewater disposal wells in the Permian Basin following a series of drilling-related earthquakes. (Capital & Main)

POLLUTION: Advocates call on the U.S. EPA to clamp down on smog-forming emissions from Wyoming coal plants and oil and gas facilities rather than waiting for the state to come up with its own plan. (Inside Climate News)

COAL: A western Colorado community works to build up its tourism and outdoor recreation industries to help it weather the 2028 retirement of a major coal plant and mine. (Rocky Mountain PBS)

WIND:

SOLAR:

UTILITIES: Nevada regulators reject NV Energy’s proposed rate hike for customers in the northern part of the state, saying it was an “inordinately large” increase. (Nevada Independent)

ELECTRIC VEHICLES: The Port of San Diego begins operating two 400 ton electric cranes. (Electrek)

LITHIUM: Hualapai tribal members urge a federal judge to extend an exploratory drilling ban at a proposed lithium mine in western Arizona, saying it would harm culturally significant lands. (Associated Press)

STORAGE:

COMMENTARY: A California columnist calls on Gov. Gavin Newsom to sign 13 climate-related bills including ones that would expedite more rooftop solar, encourage home electrification and clear the way for oil and gas drilling bans. (Los Angeles Times)

OIL & GAS: The number of climate lawsuits filed globally against top fossil fuel companies has nearly tripled since 2015, with the majority coming from U.S. cities and states. (The Guardian)

ALSO:

ELECTRIC VEHICLES:

CLEAN ENERGY:

WIND: Many East Coast states are relying on planned offshore wind projects to meet their renewable power goals, but recent GE Vernova blade failures worry some observers, like the fishing community, about the safety and reliability of the components. (New York Times)

COAL: Pittsburgh-area environmental justice activists say discussion around a federal plan to block the U.S. Steel-Nippon Steel merger ignores their concerns around coal-related air pollution. (EHN)

BIOFUELS: The fledgling sustainable aviation fuels industry faces high expectations and big questions as it gathers for a national summit in St. Paul this week. (Star Tribune)